INTRODUCTION

Whether purchasing a car, picking up coffee, or paying a contractor, consumers play an important role in the U.S. economy, where personal consumption represents around 70 percent of the nation’s gross domestic product (GDP).1 It comes by no surprise, then, that consumer optimism acts as an important indicator for the overall strength of the economy. For Florida’s businesses and policymakers confronting the COVID-19 pandemic, understanding consumer confidence will be vital to any sustainable recovery as purchasing decisions will undoubtedly play a part in any economic rebound.

CONSUMER CONFIDENCE IN FLORIDA

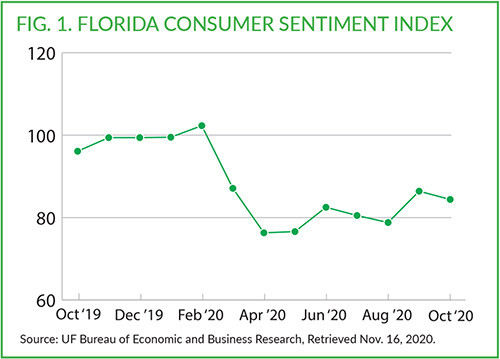

Often cited by government officials, news organizations, and research economists, “consumer confidence” refers to the degree of optimism that consumers feel about their personal financial situations and the overall state of the economy. When consumers are more optimistic, they are more likely to purchase goods and services, boosting economic activity. On the other hand, when consumers are less confident about the economy, they are more likely to save money and make fewer purchases. According to University of Florida’s Consumer Sentiment Index,2 consumer confidence in Florida plummeted 26 points from February to April, coinciding with the initial peak in COVID-19 cases across the state and the subsequent stay-at-home order (see fig. 1). After bottoming out at a low score of 76.3 in April, consumer confidence ebbed and flowed over the following few months. To put this drop in context, during the Great Recession between December 2007 and June 2009, the largest drop in confidence was around 15.1 points. In the early 2000s, the dot com bubble and 9/11 terror attacks led to a 9.1 point drop in Florida’s consumer confidence. Both past instances were associated with smaller reductions in confidence compared to the COVID-19 drop being witnessed today.

As of October 2020, the confidence score was 84.4—still far below pre-pandemic levels and slightly lower than the previous month of September where confidence seemed to hit a sudden surge. With COVID-19 cases rapidly on the rise across the nation, consumers are becoming more unsettled about the state of the economy. The one month dip in overall confidence between September and October was driven in large part by Floridians’ weakened views about current economic conditions.3

CONSUMER CONFIDENCE BY AGE, SEX, AND INCOME

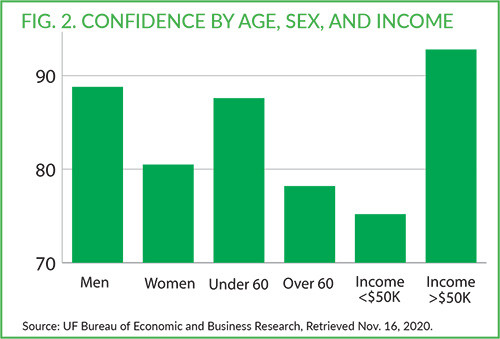

When breaking down confidence scores according to age, sex, and income, Floridians’ perceptions of the economy become more mixed and reveal important differences among various subsets of the population. Based on the most recent data available in October, men’s confidence levels were about eight points higher than women on the aggregate (see fig. 2). When it came to perceptions about personal financial situations compared to last year, men reported more positive viewpoints than women.4 For those under age 60, confidence levels were about nine points higher than those above age 60, with younger respondents signaling more positive views on personal financial situations and expected economic conditions.5

The most striking separation comes when analyzing differences according to income— between those making less than $50,000 a year and those making more than $50,000 a year. Those with more income displayed higher optimism with overall confidence being 18 points higher than those with lower incomes. Across all surveyed questions, respondents making more than $50,000 a year were more likely to believe that personal financial situations would improve in a year and that the nation’s economy would be stronger over the next five years. Additionally, they were more likely to believe now is a good time to purchase a big household item than those making less than $50,000 a year.

To explain the disparity between income groups, it is important to consider how economic factors, such as unemployment and interest rates, unequally affect different income brackets. For example, in Florida, the pandemic has had a disproportionate effect on lower paying jobs in key industries such as Leisure and Hospitality, where 482,000 Floridians lost their jobs in April.6 Without a means to pay living expenses, unemployed workers in these hardest hit industries are more likely to experience bleaker prospects for future employment compared to higher income groups where transition to remote work has led to more job security. Furthermore, those making higher incomes are also benefitting from lower interest rates, incentivizing the purchase of larger household items. This may explain why respondents making more than $50,000 a year showed greater confidence in making big purchases.

CONSUMER CONFIDENCE AS A PREDICTOR OF CONSUMER SPENDING

For an economic indicator as complex as consumer confidence, policymakers and economists go to great lengths to measure confidence for its central importance to consumer spending. Past academic research finds that consumer confidence can be a good predictor of consumer spending even after controlling for other economic variables, such as disposable income, financial wealth, and housing assets.7 Surprisingly, consumer confidence does a better job predicting consumption behavior when there are strong fluctuations in the economy, such as during a recession or political change.8 For example, the depth and longevity of the 2007-09 financial crisis can be explained partly due to the attrition in confidence among many consumers—a trend once again being observed during the COVID-19 pandemic.

Here in Florida, consumer spending dropped nearly 30 percent compared to January 1, 2020 during the state’s worst month in April.9 Between May and August, consumer spending, as a percent change from January 1, varied from -14.1 percent in early May to -2.7 percent by the end of August.10 Paralleling the surge in consumer optimism during September, consumer spending likewise increased in the Florida economy, hitting a high of +7.3 percent compared to January 1. Overall, spending in Florida has followed general trends in consumer confidence.

For the most part, trends in consumer confidence are a telling sign of consumption patterns; however, once again, this finding is tempered by differences among income groups. Past research has found that even though increases in consumer confidence are associated with an increase in consumption on the whole, those in lower income quartiles experience smaller increases in spending compared to those in the highest income quartiles.11 The smaller increase can be attributed to greater precautionary motives among those with relatively fewer assets and more allocation toward food and housing-related essentials.12

CONCLUSION

Despite its elusiveness and complexity, consumer confidence remains an important economic indicator for the strength of the economy, especially during a pandemic. Yet as this commentary has shown, what may oftentimes be overlooked is the variation among income groups when it comes to analyzing confidence and spending patterns. For any economic recovery to be robust, these differences must be taken into account and adequately addressed. As Florida approaches an uncertain holiday season, expect greater conversation about confidence and consumption as the state’s economy continues to recover.

1 Federal Reserve Bank of St. Louis, Shares of Gross Domestic Product: Personal Consumption, Updated Sept. 30, 2020. https://fred.stlouisfed.org/series/DPCERE1Q156NBEA

2 Bureau of Economic and Business Research, University of Florida, https://www.bebr.ufl.edu/csi-data. Consumers were asked a series of 5 questions about their current financial situations and future economic expectations. Scores were then compiled and ranged from 2 to 150 with scores above 100 signaling higher optimism. The index uses 1966 as the baseline year with an associated score of 100.

3 Bureau of Economic and Business Research, University of Florida, Florida Consumer Sentiment Index in October

4 Bureau of Economic and Business Research, University of Florida, Florida Consumer Sentiment Index in October

5 Ibid.

6 U.S. Bureau of Labor Statistics, Economy at a Glance: Florida, Data extracted on Nov. 10, 2020.

7 Dees & Brinca (2011). “Consumer Confidence as a Predictor of Consumption Spending: Evidence for the United States and the Euro Area.” European Union (EU) Central Bank. Published on June 2011. https://core.ac.uk/download/pdf/6580955.pdf

8 Ibid.

9 Harvard University, Opportunity Insights Economic Tracker, Percent Change in All Consumer Spending: Florida, Retrieved October 28, 2020. https://tracktherecovery.org/

10 Ibid.

11 Federal Reserve Bank of Chicago, “Trends in Consumer Sentiment and Spending” by Maude Toussaint-Comeau and Daniel DiFranco.

12 Deloitte, “Consumer Spending: Understanding What It Is and How It Is Evolving,” Nov. 27, 2018. https://www2.deloitte.com/us/en/insights/economy/spotlight/economics-insights-analysis-11-2018.html

Jonathan Guarine, MS, ResearchAnalyst, Primary Author

Robert Weissert, Executive VP & General Counsel

Chris Barry, Vice President of Communications

Senator George S. LeMieux, Chairman of the Board of Trustees

Dominic M. Calabro, President and CEO, Publisher & Editor

Florida TaxWatch Research Institute, Inc. www.floridataxwatch.org