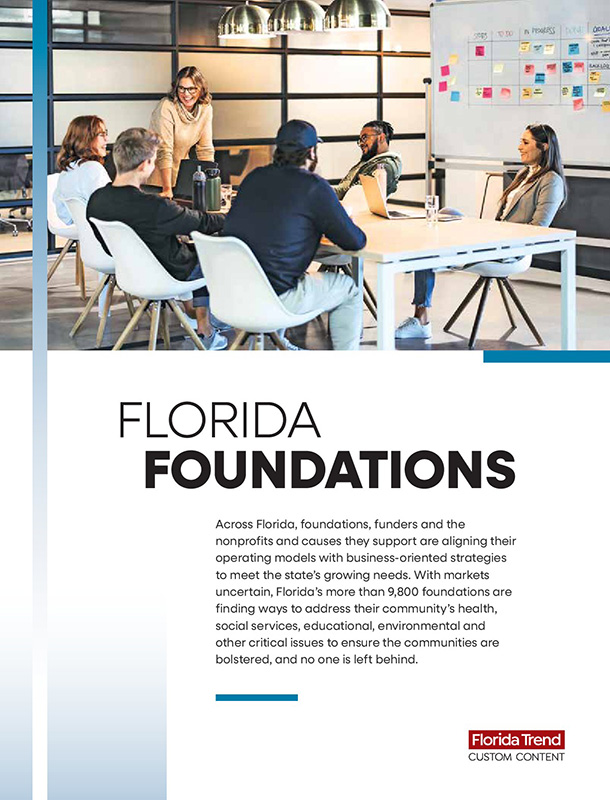

You don’t have to continually be on the lookout for new people to hire. Instead, why not nurture the employees you already have? Encourage their ideas and welcome their suggestions, then reward them in meaningful ways such as delegating responsibility so that they feel valued and trusted.

Whew! Building a business step-by-step from the ground up isn’t easy, is it? But here’s the good news: You are more than half-way into your journey to become an entrepreneur, which means much of the heavy lifting is already behind you.

If you have followed our steps to date, your business is either up and running right now or very close to it. You’ve prepared for contingencies good and bad. You’ve set yourself up to make a profit. And you’ve hired good people as needed.

With these important accomplishments behind you, now is a good time to assess your progress, tweak your day-to-day operations and begin to plan for future growth.

Here are some suggestions to get you started:

- Pay attention to and nurture your employees.

- Hiring the right people is no easy job, so when you find them, hang on to them.

- Establish clear goals and be available to answer questions and offer guidance as needed.

- Respect the individual abilities of your employees; rely on their instincts and give them room to flourish.

- Reward them — not just with money but in novel ways too, such as a gift card, a spa day or a dinner for two.

- Conversely, if you see an employee do something you don’t approve of, say so — but never in front of customers or other staff members.

- There are many more jobs available these days than applicants to fill them so you must adjust your hiring practices accordingly.

- Change the dynamics of your hiring altogether. On the heels of COVID-19, consider this: Prospective employees are less interested in money than in feeling valued and safe.

- Delegate responsibility and give your employees breathing room. Don’t hover. Instead, encourage their ideas and, whenever possible, provide opportunities for them to build confidence by taking on new and challenging tasks.

Make cash flow your No. 1 priority. If you do not currently have enough cash in your checking account to pay monthly bills, take these four steps now:

- Establish a line of credit with your bank so that you can weather seasonal ups and downs and the occasional crisis. You’ll pay no interest charges until you draw on it.

- Age your accounts receivable by grouping them as current, 30-60 days and over 60 days; don’t let unpaid accounts linger.

- Negotiate longer payment terms with suppliers in case ruined stock needs to be replaced immediately and unexpectedly.

- Keep track of when your expenses come due — monthly, quarterly, annually — and create a written schedule to avoid being caught short-funded.

Know What You're

Getting Into STEP 2

Name It. Site it. File the Necessary Paperwork. STEP 3

Abide by

the Law STEP 4

Put Your Plans

in Writing STEP 5

Find a Way to

Pay for it STEP 6

Prepare for the

Unthinkable STEP 7

Hire the Right People ...

or Maybe None at All STEP 8

Allow Yourself to

Prosper in Place STEP 9

Get the

Word Out STEP 10

Plan to Expand ...

Beginning Right Now Profiles

Small Business

Success Stories Ask an Expert

Business Information

Resources