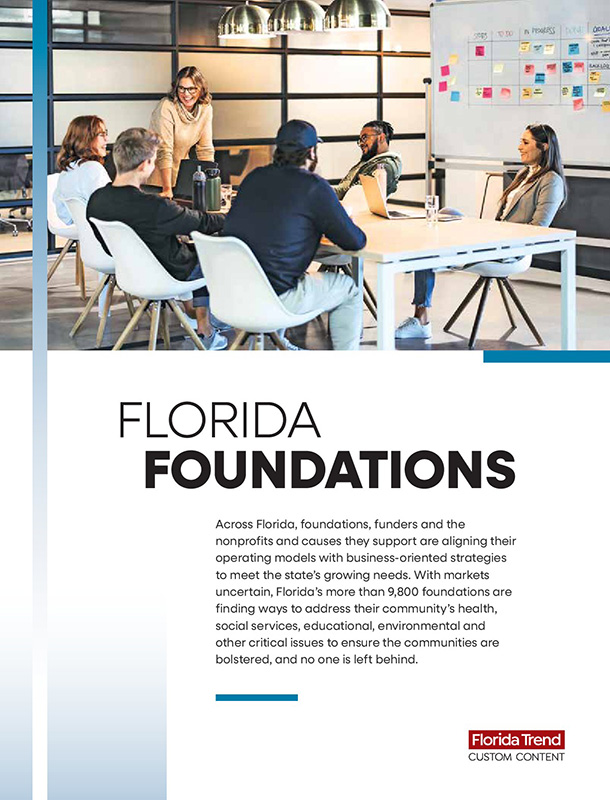

Small business growth has been on a record pace since the height of the pandemic. Whether side hustles or full-time startups, some 10.5 million new business applications were filed in the past three years alone.

But side hustles and startups don’t thrive on their own, and successfully “hanging your shingle,” especially if you have partners, takes more than registering with the state or federal government. Consider the tips below to help guide and protect you and your fledgling company …

Sign a business “prenup.” When launching a business with a partner, no one plans for irreconcilable differences. However, if you have one or more business partners, even a relative or a friend, conflicts can arise. A shareholder or operating agreement — akin to a prenuptial agreement for your business — defines roles and responsibilities, profit distribution, ownership shares, even how or to whom shares can be distributed if one partner decides to exit the business.

Beware conflicts of interest. If your new business is a side hustle, will your current employer feel threatened — especially if you plan to practice in the same or a related field? Don’t risk being fired or sued. Talk to your employer to ensure you’re not violating any non-compete agreement or the spirit of your engagement.

Formalize your corporate structure. If you’re taking your business beyond the sole proprietor stage and bringing on employees, vendors or sub-contractors, consider incorporation. This can limit personal exposure, especially if you sell products, and offer salary, tax deductions and other benefits not found with sole proprietorship. An LLC offers both liability protection and flexibility in ownership and rights. An S-Corporation is a simple option for those providing services, as opposed to goods, with flexibility and tax benefits for salary, profits and dividends. A C-Corporation often is better suited to companies that see growth requiring capital, investors or ownership shares being created or offered.

Not-for-profits or cause-related enterprises. Businesses that fall between seeking a profit and serving a social benefit may qualify as a low-profit limited liability company (L3C). This IRS designation simplifies investments in socially beneficial, for-profit ventures, allowing them to pursue a public good, while seeking a profit (and paying taxes).

Enlist your counsel. As millions of new business owners have found, the forms and documents required by the state and IRS to incorporate can be easy to complete. The legal, financial, corporate planning and other details related to business formation, however, can be confusing. If done incorrectly, they can have serious ramifications on the business and owners. Enlist your attorney, accountant, and business advisor early in the process.

To grow your hustle into a bona fide business, give it the attention it deserves. No less than the CEO of a Fortune 500 company, be the leader your business deserves.

Tanya L. Bower

Director at Tripp Scott, focusing her practice on corporate and entrepreneurial business and tax matters, including estate planning, asset protection and wealth preservation.

For more than 50 years, Tripp Scott has played a leadership role in issues that impact business.

Learn more at TrippScott.com.